About Us

AJX Capital is a leading real estate investment firm, providing fully vetted, cash-flowing investment fund opportunities in real estate to busy professionals. We work with individuals who are dissatisfied with the low returns from savings accounts and bonds, or who are concerned about the volatility of the stock market. We understand that each client has a unique set of needs and goals in building generational wealth. AJX combines its nationwide operating platform with in-depth knowledge of local markets and capital markets to provide the best investment opportunities available on the market.

Passive investing with AJX allows busy professionals & retirees to diversify their portfolios without the troubles associated with being a landlord by investing in exceptional real estate properties across the nation. This recession-resistant real estate model provides protection, predictable income, and peace of mind in any market condition. With AJX, busy professionals have the opportunity to earn lucrative returns at low risk, save on taxes, reach financial freedom and create a legacy asset that can be passed on to future generations.

Founded by Jesse and Lilian Trujillo, The AJX Diversified Real Estate Fund builds performance-based investment partnerships with trust and transparency.

OUR CORE VALUES

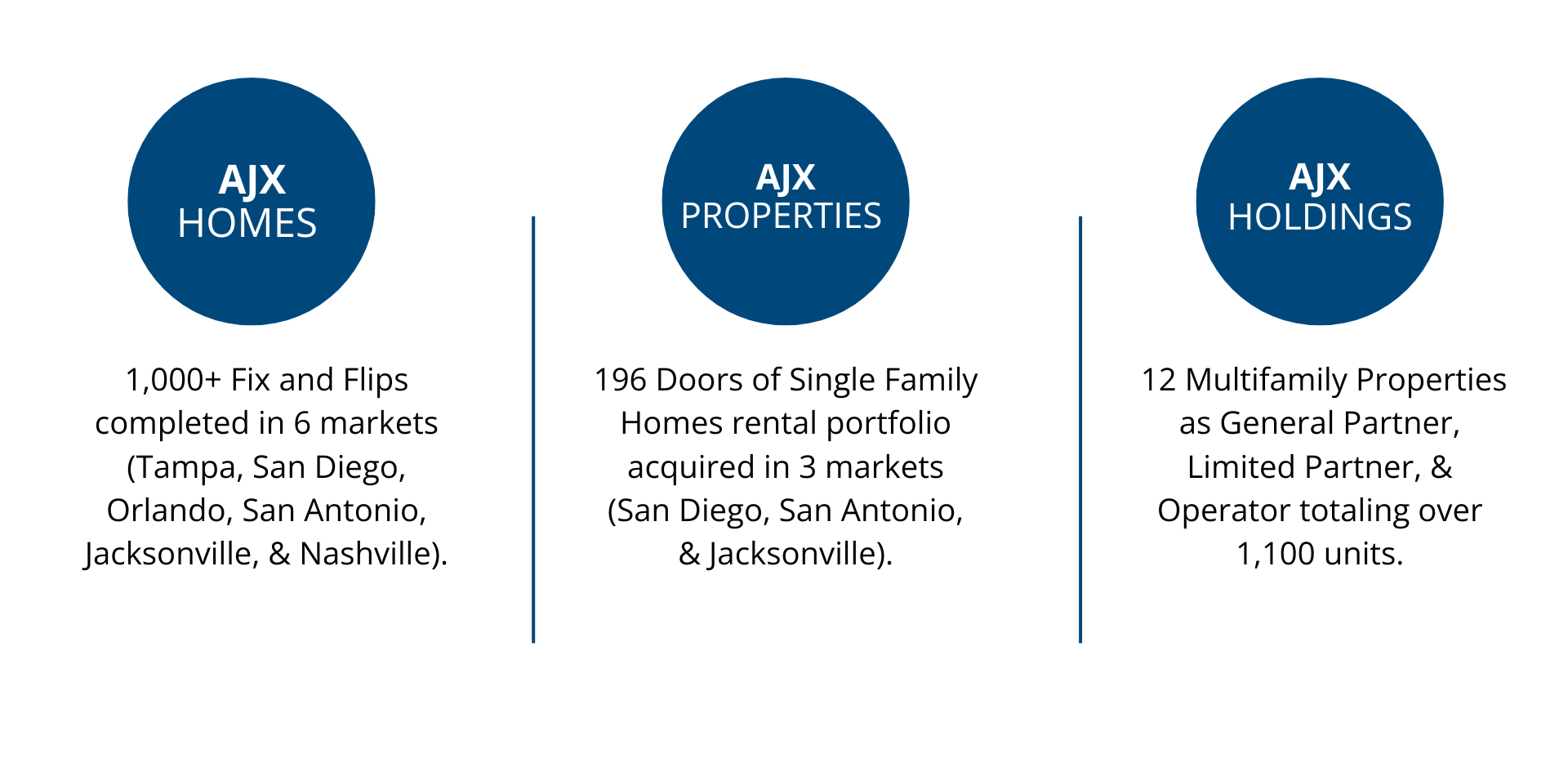

The AJX Companies

Our Leadership Team

Lilian and Jesse Trujillo

Chief Executive Officer

Jesse, Lilian Trujillo and their team at AJX, have extensive experience in all facets of Real Estate investing, spanning over 20 years. In that time, they have purchased and sold over 1,000+ properties with a total market value in excess of $500 Million. AJX has accumulated an impressive 1,100+ doors rental portfolio made up of single family and several large multifamily properties worth over $100 Million of assets under management.

AJX brings value and reliability to every transaction, with their decades of knowledge in value add, funding, structuring deals, and project management. Their success story is built upon a dedication to establishing great relationships and following through on commitments.

Their ability to deliver results with integrity and transparency has made them a valued partner to customers and investors throughout the country.

Lori Bingham

Chief Operating Officer

Lori Bingham is a seasoned executive with a history in the real estate investing sectors, where she has made a significant impact as a Chief Operating Officer across multiple companies. With a leadership career spanning over multiple decades, Lori has amassed a wealth of experience and expertise in the various facets of her position.

Throughout her career, Lori has demonstrated a keen aptitude for organization, which has been instrumental in her success as a COO. Her ability to streamline operations, optimize processes, and implement efficient systems has consistently driven growth and profitability for the companies she has served.

One of Lori's standout strengths lies in her talent for building high-performing teams and fostering a positive organizational culture. Recognizing that people are the backbone of any successful enterprise, she has invested time and resources into recruiting top talent, nurturing their development, and creating an environment where individuals can thrive and collaborate effectively.

Jeremy Cisneros

Managing Director

Jeremy Cisneros is a multifamily syndicator, General Partner across 950+ units, and Managing Director of AJX Capital. Previously, he was an originator, underwriter, and closer for a nationwide commercial real estate lender specializing in ground-up construction bridge loans. During his tenure, he originated over $450 million of commercial loans, while managing a portfolio of $250 million during the pandemic. Preceding his banking role, Jeremy owned and operated several franchises, including seven McDonald’s locations throughout Manhattan. His experience as a hands-on operator has ingrained him to look beyond the P&L. Creating financial models is one component, but understanding and ensuring these projections become reality is most critical.

As a real estate Limited Partner investor himself and a prior business owner, he understands the grave importance of investing your hard-earned dollars. He takes a methodical approach to financial modeling and conservative forecasting to ultimately reduce risk for his investors and partners.

Abby Calabrese

Fund Manager

Abby is a seasoned real estate fund manager who brings a wealth of expertise in financial services and real estate investment management. Throughout her career, she has successfully navigated both publicly traded companies and high-growth startups, negotiating deals with Fortune 500 companies and leading transformative initiatives across a variety of sectors.

Before joining AJX Capital, Abby served as the Chief Operating Officer (COO) of TEM Capital, where she played a pivotal role in leading the firm’s investor relations and capital raising efforts. Her leadership in these areas was instrumental in fostering key relationships and securing investment partnerships that supported the firm’s growth.

Now at AJX Capital, Abby is excited to contribute her talents to drive the success of the AJX Diversified Real Estate Fund.

Abby’s blend of strategic leadership, financial acumen, and relationship-building expertise makes her a key figure in AJX Capital's mission to provide exceptional value to its investors and partners.

Paul Dufour

Underwriter / Investor Relations

Paul's journey encompasses a diverse array of experiences, from the courts to the boardroom. As an Academic All-American Basketball Player at the University of New Hampshire, he not only excelled in athletics but also demonstrated exceptional academic prowess. With a passion for promoting health and wellness, Paul co-owned Fitness West, a premier health club in Pacific Beach, CA, for over three decades. His dedication to fostering community well-being earned him widespread admiration and respect.

In the financial realm, Paul has been a stalwart presence as a loan officer since 1989, he has been instrumental in securing private money funding, empowering individuals to achieve their financial goals. Furthermore, Paul's expertise extends into trust deed investing since 1993, with a robust portfolio to include 500 AJX loans. His astute investment strategies have contributed to his reputation as a trusted authority in the field. Through his multifaceted career, Paul continues to leave an indelible mark, combining his passion for sports, wellness, and finance to make a positive impact in every endeavor he undertakes.

What Our Investors Are Saying

"Over many years of successfully investing with AJX Homes, Jesse, Lilian and all the team have always been professional, knowledgeable and responsive with any questions that may arise in their investments."

- Peter D., Investor

"We have been trust deed investors for almost 30 years and one constant during the ups and downs has been investing in over 250 loans with AJX. Jesse and Lilian have been incredibly successful in business but have stayed grounded and humble. The couple I met almost 15 years ago are the same today as they were then."

- Paul and Marsha D., Investor

"Their integrity and business acumen have been proven time and again. I trust Jesse and Lilian to safeguard my investments in their projects and feel fortunate to work with such quality people who continue to prove themselves as valued business partners and friends."

- Mike B., Investor

"The AJX team has consistently been the best firm to work with. They always get good deals and buy smart, and their finished rehabbed projects look great. I did my first deal with Jesse in 2013 and have been doing business with his team for 10 years now."

Adam G., Investor

Ready To Get Started?

Sign up for our investment portal, confirm your accreditation, and view all available investment opportunities.

Learn more in a one-on-one meeting with our investment specialist to get your questions answered and get started.

Join Founder & CEO Jesse Trujillo and our investment specialist for a live webinar covering market insights, AJX strategy, investment opportunities, and Q&A.